What type of investor are you?

Pessimists sound smart, optimists make money

The above saying is true regardless of whether you are an investor allocating money to the stock market or an entrepreneur setting up a business. In order to advance in life, assuming that you want to, we need to take risks. If things turn out in our favour we become successful and make money. However, if unforeseen events occur, then we need to manage the downside risks.

In the stock market there is another similar saying; bulls make money, bears make money, pigs get slaughtered. This saying is warning about becoming greedy when markets are moving your way and all investment decisions lead to profits at that point in time. In the same way that trees don’t grow to the sky, bull and bear markets don’t last forever.

It is important to try to recognise what the current state of the stock market is, and manage risk such that if conditions suddenly change, we don’t give back all of the gains that we made.

The term bull market is used when market participants expect prices to rise, because the long-term trend of the market appears to be up. On a day-to-day basis, markets may be volatile and finish up or down depending on news flow. But in a bull market, prices rise over a period of weeks/months/years. Buy and hold works well during a bull market.

The opposite of a bull market is a bear market.

Bear markets are when market participants expect prices to fall, because the long-term trend of the market appears to be down. Again, on a day-to-day basis, markets may finish up or down, but in a bear market prices fall over a period of weeks/months/years. Buy and hold does not work well during a bull market and some market participants prefer to sell and wait for the trend to turn back up. Sophisticated investors use hedging strategies such as shorting or put options to try to profit from the falls, whilst remaining invested in the markets for the long term.

That makes things straight forward, we just need to be invested during the bull markets and avoid the stock market during the bear markets. If only life was that easy! How do we know when we are in a bull or bear market?

Historic Stock Market Cycles

Boom and busts occur much more frequently than many imagine and by studying historic stock market cycles we can learn a lot about their expected duration and also what to expect along the way. It is not uncommon to see a 10% fall in the stock market each year and you can expect a 20% drop at least every 5 years.

In the late 1800s/early 1900s business men and scientists such as Joseph Kitchin, William Stanley Jevons, John Mills, Clement Juglar and Nikolai Kondratieff, to name a few, started to formulate theories about recurring business cycles of various lengths and established the concept of the business cycle.

A cycle doesn’t mean that the same exact thing will happen over and over again. A cycle is a sequence of events that repeat over time. The outcome won’t necessarily be the same each time, but the underlying characteristics are the same. A good example is the seasonal cycle. Each year we have spring, summer, autumn and winter, and after winter we have spring again. But the weather can, and does, vary a great deal from one year to another. And so it is with the stock market.

General interest in cycles wanes during the boom times (“who cares I am making money”) only to resurface during prolonged corrections, as economists and investors seek to understand why the usual short sharp recession has not been followed by a recovery. This was true in the 1930s and is the case once again.

Business Cycles

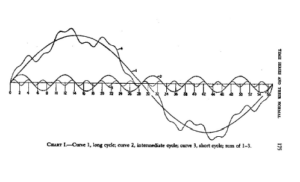

In the 1930s economists Joseph Schumpeter and Simon Kuznet did much to progress the concepts of cycles in innovation and economic development. In his book Business Cycles: A Theoretical, Historical and Statistical Analysis of the Capitalist Process, Schumpeter suggests a model in which the four main cycles (Juglar, Kitchin, Kuznets and Kondratieff) are multiples of each other and can be added together to form a composite cycle.

Schumpeter wrote: “But there is no rational justification that the writer can see for assuming that the integral number of Kitchins in a Jugular or of Juglars in a Kondratieff should always be the same. Yet from the study of our time series we derive a rough impression that this is so. Barring very few cases in which difficulties arise, it is possible to count off, historically as well as statistically, six Juglars to a Kondratieff and three Kitchins to a Juglar-not as an average but in every individual case.”

Source: Joseph A. Schumpeter, Business Cycles: A Theoretical, Historical and Statistical Analysis of the Capitalist Process

Analysis of world GDP growth rates by Andrey V Korotayev, and Sergey V Tsirel identifies cycles of approximately 4 years, 9 years 18 years and 53 years that correspond with Kitchin, Juglar, Kuznet and Kondratieff cycles respectively.

Stock Market Cycles

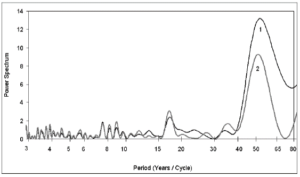

We can see that there is good evidence for regular business cycles of fixed durations but how does this apply to the stock market? JM Hurst was a former NASA engineer who used frequency analysis to identify stock market cycles. The longer-term cycles that Hurst identified were 18 years, 9 years, 4.5 years and 3 years. These are described in his book The Profit Magic of Stock Transaction Timing. Hurst set out a number of principles of cycle theory and also believed that the larger cycles are multiples of the small cycles.

Well known investors such as Warren Buffett and Jim Rogers have both written about 17-18 year stock market cycles and numerous analysts have constructed charts showing 18 year bull and bear market cycles. Cycles of approximately 18 years have been documented by many stock market commentators.

The 17.6 Year Stock Market Cycle

Art Cashin was, as far as I am aware, the first person to mention the 17.6 year stock market cycle. In an interview on CNBC he mentioned why the bear market that started in 2000 would last until 2017. Steven Williams from CyclePro Outlook has also written about the 17.6 year stock market.

My own research, without knowing about Art Cashin and Steven Williams, also identified the existence of a 17.6 year stock market cycle. When I read about Cashin and Williams I found it incredible that three people could independently identify such a specific cycle. However, I have gone a step further, I have identified a regular 17.6 year stock market cycle consisting of increments of 2.2 years that correspond to major cyclical stock market turning points such as 1929, 1987, 2000 and 2007 and beyond.

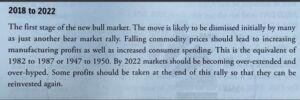

In 2013 I published my book The 17.6 Year Stock Market Cycle, Connecting the Panics of 1929, 1987, 2000 and 2007. Back in early 2013 everyone was bearish after the global financial crisis. Whilst stock markets had recovered from their 50% drops in 2008/09, US markets were testing the highs of 2000 and 2007 and most investors couldn’t see a catalyst for markets to make new highs and break out into a new bull market. I correctly forecast the return of the bull market, as stated in the cover story of Investors Chronicle, I also showed that based on historical cycles the next bull market would really get going in 2017 and last until 2035!

Whilst it is interesting to look back at those forecasts and wonder where the markets will be in 2035, more relevant to an investor today is what I wrote about 2022.

John F. Kennedy is credited with saying “a rising tide lifts all boats.” It is true that a bull market can make all investors’ money and make them look and feel smart.

But Warren Buffett has a salutary lesson “only when the tide goes out do you discover who’s been swimming naked.”

The important take away from the existence of market cycles is that investors can’t be blindly optimistic. We need to monitor the ebb and flow of market cycles to determine when to back off the accelerator as other investors are getting carried away. At the end of a bull market, valuations can become unrealistic and completely detached from the fundamentals of the business. It’s a psychological battle to start to withdraw from an over extended market. Everyone wants to extract every last pound of profit from the bull market.

I’m not saying that we are at the end of the bull market yet. Yes, things got crazy in 2021, crypto rocketed, Bored Ape jpegs were bought as if they were art and if that wasn’t enough, people started to buy real estate in the metaverse! However, while tech got overheated, stock market valuations remained reasonable.

Inflation is coming under control, central bank interest rate rises appear to be closer to completion and consumers appear to have weathered the storm of surging energy and food prices as well as mortgage interest rate rises. The stock market is primed for its next leg up, and it may well get a boost from money moving out of commercial real estate and buy to let, as the long-term property cycle tops out!

About Kerry Balenthiran

Kerry Balenthiran studied mathematics at the University of Warwick and then worked as a Spacecraft Operations Engineer in the UK and at the European Space Agency. He qualified as a chartered accountant with Arthur Andersen and now works in risk management within financial services. His mathematical background led to a fascination with the cyclical nature of stock market booms and busts.