Where are the stock markets headed next, some tech stocks are soaring while others are struggling.

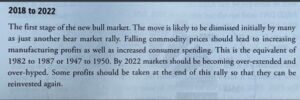

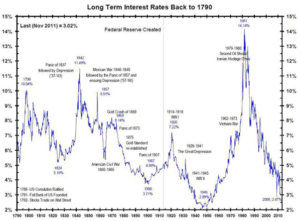

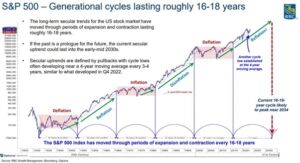

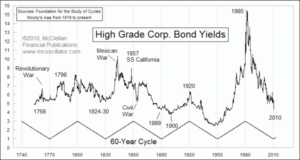

It’s hard to see any obvious pattern but there appears to be long secular trends at play, including a roughly 35 years low to high, high to low cycle.

It’s hard to see any obvious pattern but there appears to be long secular trends at play, including a roughly 35 years low to high, high to low cycle.

Cycles analysis isn’t as precise as some make out, or as many would like it to be. It provides a roadmap for anticipating future price action, along with other empirical data, but price is always the key piece of information. However, studying cycles forces the mind to consider what events may cause the current trend to stop and reverse. Investors don’t do this enough in my opinion. It is human nature to get carried away at the end of the trend and assume that the current conditions will continue forever, and that we have entered a new paradigm. As the saying goes, history doesn’t repeat, but it often rhymes.

Summary

The next three to six months may cause markets to fall back, but I consider any pullback as the opportunity to put more money to work in the stock markets in order to take advantage of the forecast final blow off leg to the stocks bull market through to 2035.